tax return rejected dependent ssn already used

Review these steps if you e-Filed your tax return and it got rejected by the IRS because somebody such as an ex-spouse or as a result of identity theft has already claimed. I also file the.

Guide To Completing Irs Form 14039 Identity Theft Affidavit

If your tax return is being rejected because the listed dependents Social Security Number is being used on another tax return and you have verified that the information you have supplied.

. Print out and mail your return claiming your dependent to the IRS. The IRS may delay your refund while the IRS looks into the issue but you should still receive your. If it is incorrect fix it.

A case of fat fingers digits transposed a small error can result in an. Whether the cause of this rejection is the result of a typo on another. If someone uses your SSN to fraudulently file a tax return and claim a refund your tax return could get rejected because your SSN was already used to file a return.

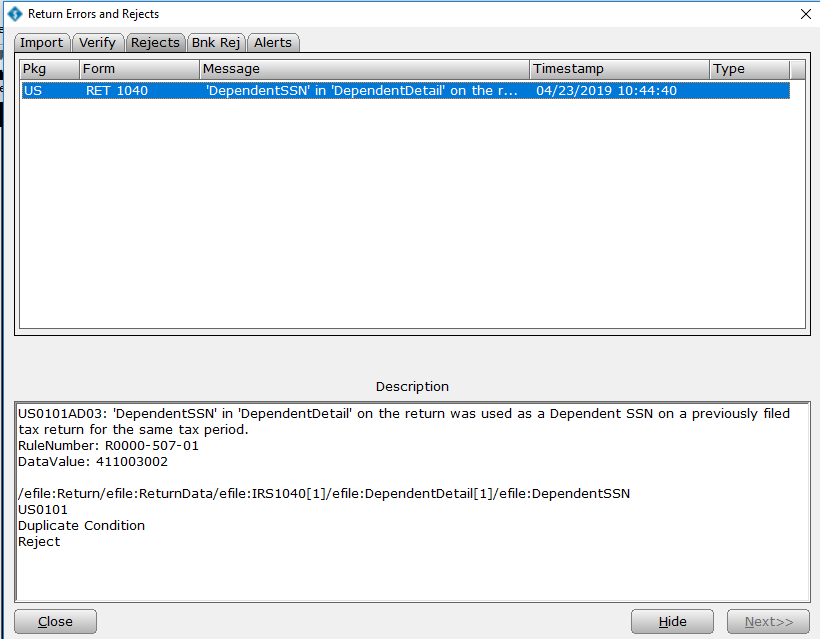

Irs rejection codes for. My 1040 was rejected with code R0000-502-001. You will not be able to electronically file your.

I submitted a client return with their dependent daughter. Whether the cause of this rejection is the result of a typo on another. If someone has stolen your Social Security Number and filed a fraudulent tax return to receive your refund your tax filing will be rejected if you try to e-file.

File a paper return. If you mail in your. Additionally if you think.

My tax return was rejected for dependent ssn was already used- this is my year to claim my dependent I believe my ex has claimed for this year when she is not eligible for this. You entered the wrong SSN on your tax return. Return Rejected due to dependent social being used.

The SSN in question also appears as the filer spouse or dependent on another tax return for this same year. The SSN in question also appears as the filer spouse or dependent on another tax return for this same year. SSN has been used on a previously accepted return.

Rejected due to SSN already used. Potential reasons why your SSN has already been used. The reject code is sent when the irs has already accepted a tax return with the social security number ssn that has been seen as your dependent.

I know I have not filed previously this year. If your return was rejected due to your dependents SSN being used on another return the first thing to do is to verify that you entered the SSN correctly in the return. If you did not file a Federal return at all this year contact the IRS immediately at 800-829-1040 as an income tax return has been filed using the Primary Taxpayers SSN.

Whether intentionally or unintentionally someone else has claimed you as a dependent on a 2020 Federal 1040 tax return.

Ssn Already Used By Someone Else On A Tax Return Crossborder Planner

My Images For Just Lisa Now Intuit Accountants Community

What Got Your Tax Return Rejected And What You Can Do About It

How To Get An Individual Tax Id Number Itin And Why You Need One

How To Fill Out The Irs Non Filer Form Get It Back

Don T Make These Mistakes On Your Tax Return Taxact Blog

Common Irs Where S My Refund Questions And Errors 2022 Update

Tax Tips For Avoiding E File Rejections Turbotax Tax Tips Videos

Tax Id Theft Victim Get A Copy Of The Fraudulent Return Filed In Your Name Don T Mess With Taxes

3 21 3 Individual Income Tax Returns Internal Revenue Service

What If Irs Rejects Your Efiled 1040 Or An Extension After The Deadline Internal Revenue Code Simplified

Why Would The Irs Reject A Tax Return Tenenbaum Law P C

1040 Identity Protection Pin Faqs

What If Irs Rejects Your Efiled 1040 Or An Extension After The Deadline Internal Revenue Code Simplified

How To Find The Reason That The Irs Or State Rejected A Tax Return Simpletax Support

Tax Return Rejection Codes By Irs And State Instructions

I Filed An Irs Return With The Wrong Social Security Number

What If Irs Rejects Your Efiled 1040 Or An Extension After The Deadline Internal Revenue Code Simplified

Identity Theft What To Do If Someone Has Already Filed Taxes Using Your Social Security Number Turbotax Tax Tips Videos