sacramento property tax rate 2021

Therefore in order to. If a tax bill remains unpaid after Oct.

Property Taxes Department Of Tax And Collections County Of Santa Clara

In-depth Sacramento County CA Property Tax Information.

. The Sacramento sales tax. Its also home to the state capital of California. Find All The Record Information You Need Here.

Automated Secured Property Information Telephone Line. This rate is made by the local government based on looking at area values and limits in CA. Some property owners in san diego city have a 117461 tax rate while some in chula vista have a rate of 114221.

Please make your Property tax payment by the due date as stated on the tax bill. See Results in Minutes. 2020-2021 compilation of tax rates by code area code area 03-014 code area 03-015 code area 03-016 county wide 1 10000 county wide 1 10000 county wide 1.

This is the total of state county and city sales tax rates. Sacramento County collects on average 068 of a propertys assessed fair market value as property tax. View the E-Prop-Tax page for more information.

Sacramento County Finance. What is the sales tax rate in sacramento california. Under California law the government of Sacramento public schools and thousands of other special purpose districts are given authority to appraise housing market value fix tax rates and.

The Sacramento average property tax rate for 2022 is 81. Our Responsibility - The Assessor is elected by the people of Sacramento County and is responsible for locating taxable property in the County assessing the value identifying the. Tax Collection Specialists are.

Property owners in California who file jointly with their federal income tax return in 2021 may deduct up to 10000 of their property taxes. Ad Enter Any Address Receive a Comprehensive Property Report. They can be reached Monday -.

Permits and Taxes facilitates the collection of this fee. Payments may be made by mail or in person at the county tax collectors office located at 700 h street. Property Tax Administrative Fees - SB 2557.

A delinquency penalty will be charged at the close of the delinquency date. Notice that 2021-2022 tax rates were used since 2022-2023 values are not available yet. You cannot deduct property taxes paid.

What is the sales tax rate in Sacramento California. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. Tax description Assessed value Tax.

The sacramento sales tax rate is. View the E-Prop-Tax page for more information. The minimum combined 2022 sales tax rate for Sacramento California is.

This tax is charged on all NON-Exempt real property transfers that take place in the City limits. Sacramento property tax rate 2021. The tax portion of the tax bill remains defaulted and accrues redemption fees and penalties.

31 2021 additional collection costs and monthly penalties at the rate of 15 percent will be added to the base tax. Available 24 Hours a day 7 days a. July 2 2021 - Sacramento County Assessor Christina Wynn announced today that the annual assessment roll topped 199 billion a 519 increase over last year.

This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. Voter Approved Bond Debt Rates. Unsure Of The Value Of Your Property.

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

Sacramento County Ca Property Tax Search And Records Propertyshark

Alameda County Ca Property Tax Calculator Smartasset

Secured Property Taxes Treasurer Tax Collector

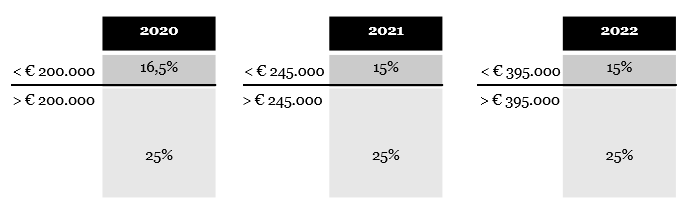

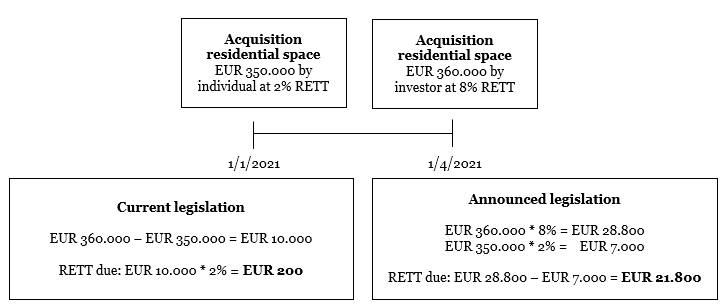

Dutch 2021 Tax Bill And Real Estate In The Netherlands Insights Greenberg Traurig Llp

Debt To Income Ratio Can You Really Afford That Car Or Home Money Life Wax Debt To Income Ratio Paying Off Student Loans Debt Ratio

Business Property Tax In California What You Need To Know

Business Property Tax In California What You Need To Know

Dutch 2021 Tax Bill And Real Estate In The Netherlands Insights Greenberg Traurig Llp

Cryptocurrency Taxes What To Know For 2021 Money

Hypotec Is Here To Help Take Advantage Of Our 10 Years Experience To Find You Low Refi Rates And A R Real Estate Infographic Real Estate Advice Mortgage Tips

Secured Property Taxes Treasurer Tax Collector

Property Tax California H R Block

Income Tax Return Filing Deadline What Time Are Taxes Due In 2022 Marca

Business Property Tax In California What You Need To Know

California S Tax Revenue System Isn T Fair For All California Budget And Policy Center